Collective Dominance Through Tacit Coordination: Application of Game Theory to Indian Antitrust Law

- Charu Sharma, Rishabh Periwal

- Apr 26, 2022

- 9 min read

[Charu and Rishabh are students at National Law University, Jodhpur. The following post is one of the winning entries in the Second IRCCL Blog Writing Competition (2021-22), organised in association with Khaitan & Co.]

Section 4 of the Competition Act, 2002 (Act) has often been criticised for not penalising collective dominance. While the legislation clearly penalises abuse of dominant position by a single entity, it does not recognise the concept of collective dominance and the same has sparked a legal debate as to whether or not India should recognise and then, penalise abuse of collective dominance.

While the criticism regarding the Indian legal position on collective dominance had been mounting up, the 2019 Report of the Review Committee on Competition Law (Report) addressed doubts regarding whether or not collective dominance can be recognised in India. It stated that Section 4 does not recognise the concept of collective dominance. However, at the root of it, the concept of collective dominance seeks to attack anti-competitive trade agreements and the same is sufficiently covered by Section 3 of the Act. The committee, therefore, concluded that there was no gap in the law and no need to exclusively recognise the concept of collective dominance.

In light of the above-mentioned, the authors partly agree with the Report. The issue of collective dominance is unavoidable in an oligopoly and the same has been explained through the application of game theory. However, even though Section 3 of the Act seems sufficient to deal with the issue of abuse of collective dominance, it falls short in recognising the signs of collective dominance through tacit coordination due to a lack of uniform standards for identifying tacit coordination, a key part of abuse of collective dominance.

What is Collective Dominance?

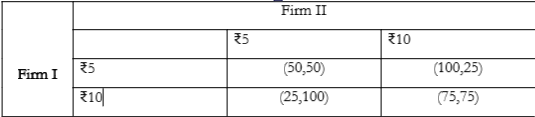

If one were to view an oligopolistic market as a game, the enterprises engaged in the market would be the players who seek to obtain the winning prize of the game, which are maximum possible profits. In an oligopoly, the quantity that each firm will be able to sell of a non-differentiated product depends heavily on the difference in the selling price of the products. Consider the following example of a market that has two firms that are considering how to determine the price of their products.

In the above matrix, both the firms are able to get a profit of ₹50 if they sell their products for ₹5. If Firm I were to sell its product at ₹5 while Firm II sells its product at ₹10, Firm I will be able to derive a profit of ₹100 while Firm II derives a profit of only ₹25 and vice versa. If both firms sell their product at ₹10, then they both will be able to derive a profit of ₹75. When these firms analyse the strategies available to them, they shall come to the conclusion that the best strategy possible for them is to sell their product at ₹5.

However, the problem arises in an oligopoly when the collectively dominant firms are tacitly coordinating and thus are aware that even if they increase their price to ₹10, the firm that it is competing with will also increase their price to ₹10. This limits competition in the industry and results in a situation where the collectively dominant firms start abusing their dominant position.

Legal Recognition

The United Kingdom and the European Union (EU) recognise the issue of collective dominance. Article 102 of the Treaty on the Functioning of the European Union emulates the provision against abuse of collective dominance. It describes abuse of dominant position such as to include abuse by one or more undertakings of a dominant position within the internal market.

The EU General Court, in the case of Irish Sugar plc v. Commission, further clarified the meaning of collective dominance:

“A joint dominant position consists in a number of undertakings being able together, in particular because of factors giving rise to a connection between them, to adopt a common policy on the market and act to a considerable extend independently of their competitors, their consumers, and ultimately consumers.”

While the English law also states that two companies can have ‘collective dominance’ if they ‘are linked in such a way that they adopt a common policy on the market’, there have not been any cases wherein the concept of collective dominance had been established. Section 47 of the Singapore Competition Act also states that ‘any conduct on the part of one or more undertakings which amounts to the abuse of a dominant position in any market in Singapore is prohibited’. However, in Singapore too, there have not been any cases where the concept of collective dominance was used.

The main reason that critics employ to say that Indian law does not recognise collective dominance is the wording of Section 4. It clearly states “…position of strength enjoyed by an enterprise”. The expression “enterprise” has been defined in Section 2(h). It means either a person (including a company) or a department of the government. When it was suggested in 2012 by way of a bill that the phrase “jointly or singly” should be included in Section 4, the same was rejected by the legislature.

Is There Room for Recognising Collective Dominance in Indian Law?

It must be noted that Section 3 of the Act prohibits an enterprise or a person or any association of enterprises or persons from entering into anti-competitive agreements. It covers agreements in respect of production, supply, distribution, storage, acquisition or control of goods or provision of services which cause or are likely to cause an appreciable adverse effect on competition within India. The courts have clarified at multiple instances that such an agreement may be formal or informal.

For instance, the Competition Appellate Tribunal (COMPAT) in International Cylinder (P) Limited v. Competition Commission of India (CCI) recognised and penalised an anti-competitive concerted agreement inferred from the conduct of the parties. This lends support to the Report’s assertion that Indian competition law has enough legal provisions to counter collective dominance by recognition of anti-competitive trade agreements, executed both overtly and covertly. While it is true that Section 3 and its jurisprudence is sufficient in recognising abuse of collective dominance through overt anti-competitive trade agreements, the same is not true for recognition of abuse of collective dominance through tacit coordination in an oligopoly.

Defining Tacit Coordination

Tacit coordination or tacit collusion refers to an oligopolistic market phenomenon where leading firms take advantage of certain features of a market and coordinate their behaviour on prices, output, etc., by taking into account their competitors’ strategies and likely reactions without getting into an overt agreement.

There need not be any communication between the parties for them to collude tacitly. It is referred to as tacit collusion only because the consequences may well resemble those of explicit collusion or even of an official cartel.

Standard for tacit coordination in India

As stated before, Section 3 allows for the penalisation of tacit collusion. However, the standards to determine whether collusion has taken place or not have not been uniform across case laws.

In Tyre Dealers Federation v. Tyre manufacturers, the CCI recognised the possibility of collusion in an oligopolistic market but with fair caution that such parallelism can only be liable for penalisation when it is rational and agreed upon and not when it is a result of market practices. It stated:

“Thus, high concentration may provide a structural reasoning for collusive action resulting in parallelism (price or output), yet it is very important to differentiate between ‘rational’ conscious parallelism arising out of the interdependence of the firms' strategic choices and parallelism stemming from purely concerted action. Thus, inferring of cartels would require further evidences. Economic theory has demonstrated convincingly that ‘conscious parallelism’, is not uncommon in homogeneous oligopolistic markets. Competing firms are bound to be conscious of one another's activities in all phases, including marketing and pricing. Aware of such outcomes especially where there is little real difference in product the CCI is of the opinion that it is quite probable that in many such instances, conscious parallelism may be dictated solely by economic necessity. Avoidance of price wars is a common instance where this takes place.”

While this distinction between conscious parallelism and parallelism as a result of market practices is an important observation to delineate collusion from business sensibility, the case did not provide a set criterion for recognising tacit collusion.

Then, in In Re: Suo motu case (LPG Cylinder case) against LPG cylinder manufacturers, the CCI laid down that in order to prove an ‘agreement’ through circumstantial evidence, the evidence must tend to “exclude the possibility of independent action”. While elaborating on what can constitute the circumstantial evidence to prove parallelism, the CCI, in the same case, held that meetings of the firms and price communications constitute evidence of an agreement. However, in a similar case in the same industry (In Re: Alleged cartelisation in supply of LPG Cylinders procured through tenders by Hindustan Petroleum Corporation Ltd. (HPCL)), the CCI held that circumstantial evidence, in absence of any corroboration by an independent witness is not admissible as evidence and conclusions cannot be based on such uncorroborated circumstantial evidence alone.

Then, in the latest case of Shikha Roy v. Jet Airways, the CCI held that the existence of an anti-competitive practice or agreement must be inferred from a number of coincidences and indicia which, taken together, may, in the absence of any other plausible explanation, constitute evidence of the existence of an agreement.

What is evident from the trends of these cases is that while the Indian jurisprudence recognises tacit collusion and has diligently delineated between rational parallelism and parallelism as a result of market strategy, it has not emphasised on how such collusion can be identified. There is no set standard for the determination of when market strategy crosses into the area of collusion. While some judgements depend on the Organisation for Economic Co-operation and Development guidelines for evidence of cartelisation, some judgements seek support from the EU’s law. Some judgements contest the sufficiency of circumstantial evidence while some say that when circumstantial evidence is available and any other inference is not logically probable, the former is enough to prove collusion.

Conclusion

It is true that collective dominance does not need an exclusive legal provision to identify its abuse. However, as has been proven above, the abuse of collective dominance is always possible in an oligopoly and since the same is done through anti-competitive trade agreements, Indian law with the help of Section 3 is sufficient enough to counter it. However, when the same abuse occurs through tacit coordination, Indian law falls short in identifying signs of tacit coordination. The same circumstantial evidence that leads to liability under Section 3 in one case is deemed insufficient in another.

The Supreme Court tried to address the issue in the case of Rajasthan Cylinders & Containers Ltd. v. Union of India, wherein it read Section 3 and Section 9 of the Act in conjunction and held that the necessary ingredients of collusion are: (a) agreement between the parties; (b) these parties are engaged in identical or similar production or trading of goods or provisions of services; and (c) the agreement has the effect of eliminating or reducing competition of bids or adversely affect or manipulating the process for bidding. It relied upon the guidelines on the applicability of Article 101 of the Treaty on the functioning of the EU to horizontal cooperation agreements which says that evidence of communication between parties like emails should be looked into to establish tacit coordination.

While this serves to identify the possible consequences of tacit coordination to establish it, it still does not provide the rationale as to how parallelism occurring due to market forces can be differentiated from collusion induced parallelism. Therefore, there is a pressing need to identify signs of tacit collusion for uniform applicability of law. For setting these standards, laws in other jurisdictions can be looked at.

The EU General Court laid down the identification factors for recognising collective dominance in Irish Sugar. It stated that two entities may still hold a joint dominant position, even if they are in fact independent from each other in economic terms. Such dominant position was ultimately found in the case where there were links making it possible for them to successfully adopt a common market policy. The links in question were that one of the firms held shares in the other firm’s parent company, and also had board members in both the parent company its subsidiary. It is apparent that such capacity made it possible for the undertakings to adopt a similar conduct on the market.

Further, the Competition and Consumer Commission of Singapore Guidelines specifically state that a collective dominant position may be held when two or more legally independent undertakings, from an economic point of view, present themselves or act together on a particular market as a collective entity. Essentially, undertakings holding a collective dominant position are able to adopt a common policy on the market and, to a considerable extent, act independently of their competitors, customers and consumers. The guidelines also advise look at whether the entities are collectively dominant in other geographical markets except Singapore.

Hence, to counter the lack of uniformity, India needs to develop a set of guidelines mentioning the relevant factors that could lead to tacit collusion by two or more dominant entities.

Comments